题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

(ii) The shares held in Date Inc and the dividend income received from that company. (7 ma

(ii) The shares held in Date Inc and the dividend income received from that company. (7 marks)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

(ii) The shares held in Date Inc and the dividend income received from that company. (7 marks)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“(ii) The shares held in Date I…”相关的问题

更多“(ii) The shares held in Date I…”相关的问题

A.One month

B.Three months

C.Six months

D.Twelve months

2005. The financial statements were authorised on 12 December 2005. The following events are relevant to the

financial statements for the year ended 31 October 2005:

(i) Ryder has a good record of ordinary dividend payments and has adopted a recent strategy of increasing its

dividend per share annually. For the last three years the dividend per share has increased by 5% per annum.

On 20 November 2005, the board of directors proposed a dividend of 10c per share for the year ended

31 October 2005. The shareholders are expected to approve it at a meeting on 10 January 2006, and a

dividend amount of $20 million will be paid on 20 February 2006 having been provided for in the financial

statements at 31 October 2005. The directors feel that a provision should be made because a ‘valid expectation’

has been created through the company’s dividend record. (3 marks)

(ii) Ryder disposed of a wholly owned subsidiary, Krup, a public limited company, on 10 December 2005 and made

a loss of $9 million on the transaction in the group financial statements. As at 31 October 2005, Ryder had no

intention of selling the subsidiary which was material to the group. The directors of Ryder have stated that there

were no significant events which have occurred since 31 October 2005 which could have resulted in a reduction

in the value of Krup. The carrying value of the net assets and purchased goodwill of Krup at 31 October 2005

were $20 million and $12 million respectively. Krup had made a loss of $2 million in the period 1 November

2005 to 10 December 2005. (5 marks)

(iii) Ryder acquired a wholly owned subsidiary, Metalic, a public limited company, on 21 January 2004. The

consideration payable in respect of the acquisition of Metalic was 2 million ordinary shares of $1 of Ryder plus

a further 300,000 ordinary shares if the profit of Metalic exceeded $6 million for the year ended 31 October

2005. The profit for the year of Metalic was $7 million and the ordinary shares were issued on 12 November

2005. The annual profits of Metalic had averaged $7 million over the last few years and, therefore, Ryder had

included an estimate of the contingent consideration in the cost of the acquisition at 21 January 2004. The fair

value used for the ordinary shares of Ryder at this date including the contingent consideration was $10 per share.

The fair value of the ordinary shares on 12 November 2005 was $11 per share. Ryder also made a one for four

bonus issue on 13 November 2005 which was applicable to the contingent shares issued. The directors are

unsure of the impact of the above on earnings per share and the accounting for the acquisition. (7 marks)

(iv) The company acquired a property on 1 November 2004 which it intended to sell. The property was obtained

as a result of a default on a loan agreement by a third party and was valued at $20 million on that date for

accounting purposes which exactly offset the defaulted loan. The property is in a state of disrepair and Ryder

intends to complete the repairs before it sells the property. The repairs were completed on 30 November 2005.

The property was sold after costs for $27 million on 9 December 2005. The property was classified as ‘held for

sale’ at the year end under IFRS5 ‘Non-current Assets Held for Sale and Discontinued Operations’ but shown at

the net sale proceeds of $27 million. Property is depreciated at 5% per annum on the straight-line basis and no

depreciation has been charged in the year. (5 marks)

(v) The company granted share appreciation rights (SARs) to its employees on 1 November 2003 based on ten

million shares. The SARs provide employees at the date the rights are exercised with the right to receive cash

equal to the appreciation in the company’s share price since the grant date. The rights vested on 31 October

2005 and payment was made on schedule on 1 December 2005. The fair value of the SARs per share at

31 October 2004 was $6, at 31 October 2005 was $8 and at 1 December 2005 was $9. The company has

recognised a liability for the SARs as at 31 October 2004 based upon IFRS2 ‘Share-based Payment’ but the

liability was stated at the same amount at 31 October 2005. (5 marks)

Required:

Discuss the accounting treatment of the above events in the financial statements of the Ryder Group for the year

ended 31 October 2005, taking into account the implications of events occurring after the balance sheet date.

(The mark allocations are set out after each paragraph above.)

(25 marks)

Germane has a number of relationships with other companies.

In which of the following relationships is Germane necessarily the parent company?

(i) Foll has 50,000 non-voting and 100,000 voting equity shares in issue with each share receiving the same dividend. Germane owns all of Foll’s non-voting shares and 40,000 of its voting shares

(ii) Kipp has 1 million equity shares in issue of which Germane owns 40%. Germane also owns $800,000 out of $1 million 8% convertible loan notes issued by Kipp. These loan notes may be converted on the basis of 40 equity shares for each $100 of loan note, or they may be redeemed in cash at the option of the holder

(iii) Germane owns 49% of the equity shares in Polly and 52% of its non-redeemable preference shares. As a result of these investments, Germane receives variable returns from Polly and has the ability to affect these returns through its power over Polly

A.(i) only

B.(i) and (ii) only

C.(ii) and (iii) only

D.All three

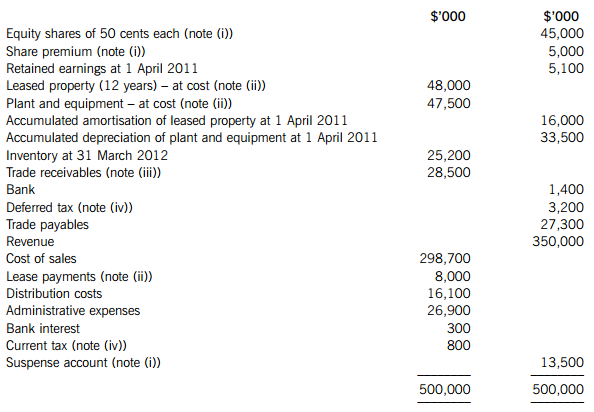

The following trial balance relates to Fresco at 31 March 2012:

The following notes are relevant:

(i) The suspense account represents the corresponding credit for cash received for a fully subscribed rights issue of equity shares made on 1 January 2012. The terms of the share issue were one new share for every five held at a price of 75 cents each. The price of the company’s equity shares immediately before the issue was $1·20 each.

(ii) Non-current assets:

To reflect a marked increase in property prices, Fresco decided to revalue its leased property on 1 April 2011. The Directors accepted the report of an independent surveyor who valued the leased property at $36 million on that date. Fresco has not yet recorded the revaluation. The remaining life of the leased property is eight years at the date of the revaluation. Fresco makes an annual transfer to retained profits to reflect the realisation of the revaluation reserve. In Fresco’s tax jurisdiction the revaluation does not give rise to a deferred tax liability.

On 1 April 2011, Fresco acquired an item of plant under a finance lease agreement that had an implicit finance cost of 10% per annum. The lease payments in the trial balance represent an initial deposit of $2 million paid on 1 April 2011 and the first annual rental of $6 million paid on 31 March 2012. The lease agreement requires further annual payments of $6 million on 31 March each year for the next four years. Had the plant not been leased it would have cost $25 million to purchase for cash.

Plant and equipment (other than the leased plant) is depreciated at 20% per annum using the reducing balance method.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 March 2012. Depreciation and amortisation are charged to cost of sales.

(iii) In March 2012, Fresco’s internal audit department discovered a fraud committed by the company’s credit controller who did not return from a foreign business trip. The outcome of the fraud is that $4 million of the company’s trade receivables have been stolen by the credit controller and are not recoverable. Of this amount, $1 million relates to the year ended 31 March 2011 and the remainder to the current year. Fresco is not insured against this fraud.

(iv) Fresco’s income tax calculation for the year ended 31 March 2012 shows a tax refund of $2·4 million. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 2011. At 31 March 2012, Fresco had taxable temporary differences of $12 million (requiring a deferred tax liability). The income tax rate of Fresco is 25%.

Required:

(a) (i) Prepare the statement of comprehensive income for Fresco for the year ended 31 March 2012.

(ii) Prepare the statement of changes in equity for Fresco for the year ended 31 March 2012.

(iii) Prepare the statement of financial position of Fresco as at 31 March 2012.

The following mark allocation is provided as guidance for this requirement:

(i) 9 marks

(ii) 5 marks

(iii) 8 marks (22 marks)

(b) Calculate the basic earnings per share for Fresco for the year ended 31 March 2012. (3 marks)

Notes to the financial statements are not required.

(ii) Explain the income tax (IT), national insurance (NIC) and capital gains tax (CGT) implications arising on

the grant to and exercise by an employee of an option to buy shares in an unapproved share option

scheme and on the subsequent sale of these shares. State clearly how these would apply in Henry’s

case. (8 marks)

(c) At 1 June 2006, Router held a 25% shareholding in a film distribution company, Wireless, a public limited

company. On 1 January 2007, Router sold a 15% holding in Wireless thus reducing its investment to a 10%

holding. Router no longer exercises significant influence over Wireless. Before the sale of the shares the net asset

value of Wireless on 1 January 2007 was $200 million and goodwill relating to the acquisition of Wireless was

$5 million. Router received $40 million for its sale of the 15% holding in Wireless. At 1 January 2007, the fair

value of the remaining investment in Wireless was $23 million and at 31 May 2007 the fair value was

$26 million. (6 marks)

Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.

(ii) The answers to any questions that the potential investors may raise in connection with the maximum

possible investment, borrowing to finance the subscription and the implications of selling the shares.

(7 marks)

Note: you should assume that Vostok Ltd and its trade qualify for the purposes of the enterprise investment

scheme and you are not required to list the conditions that need to be satisfied by the company, its

shares or its business activities.

Harry, the managing director of Gilt Ltd, has been approached by Itt plc in respect of its making a takeover bid for Gilt Ltd. Itt plc has given Harry what is described as a facility fee of £50,000 for ensuring that the takeover is successful.

At the next board meeting Harry convinces the other directors that the take-over bid is in the long-term interest of Gilt Ltd, but they are concerned that the holders of the majority of the issued share capital will not approve of the takeover.

In order to ensure the success of the takeover, the directors of Gilt Ltd agree that they should allot suffi cient new shares to Itt plc to ensure that a new majority of members will support the takeover.

After the allocation of the shares to Itt plc a general meeting is called to consider the takeover and it is approved, with Itt plc voting in favour.

May, a substantial shareholder in Gilt Ltd has subsequently found out about the actions of Itt plc, Harry and the other directors.

Required:

Advise May as to the legality of the share allotment and as to what action can be taken against Harry.

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

Section B – TWO questions ONLY to be attempted

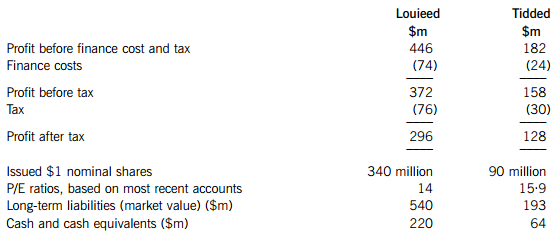

Louieed Co

Louieed Co, a listed company, is a major supplier of educational material, selling its products in many countries. It supplies schools and colleges and also produces learning material for business and professional exams. Louieed Co has exclusive contracts to produce material for some examining bodies. Louieed Co has a well-defined management structure with formal processes for making major decisions.

Although Louieed Co produces online learning material, most of its profits are still derived from sales of traditional textbooks. Louieed Co’s growth in profits over the last few years has been slow and its directors are currently reviewing its long-term strategy. One area in which they feel that Louieed Co must become much more involved is the production of online testing materials for exams and to validate course and textbook learning.

Bid for Tidded Co

Louieed Co has recently made a bid for Tidded Co, a smaller listed company. Tidded Co also supplies a range of educational material, but has been one of the leaders in the development of online testing and has shown strong profit growth over recent years. All of Tidded Co’s initial five founders remain on its board and still hold 45% of its issued share capital between them. From the start, Tidded Co’s directors have been used to making quick decisions in their areas of responsibility. Although listing has imposed some formalities, Tidded Co has remained focused on acting quickly to gain competitive advantage, with the five founders continuing to give strong leadership.

Louieed Co’s initial bid of five shares in Louieed Co for three shares in Tidded Co was rejected by Tidded Co’s board. There has been further discussion between the two boards since the initial offer was rejected and Louieed Co’s board is now considering a proposal to offer Tidded Co’s shareholders two shares in Louieed Co for one share in Tidded Co or a cash alternative of $22·75 per Tidded Co share. It is expected that Tidded Co&39;s shareholders will choose one of the following options:

(i) To accept the two-shares-for-one-share offer for all the Tidded Co shares; or,

(ii) To accept the cash offer for all the Tidded Co shares; or,

(iii) 60% of the shareholders will take up the two-shares-for-one-share offer and the remaining 40% will take the cash offer.

In case of the third option being accepted, it is thought that three of the company&39;s founders, holding 20% of the share capital in total, will take the cash offer and not join the combined company. The remaining two founders will probably continue to be involved in the business and be members of the combined company&39;s board.

Louieed Co’s finance director has estimated that the merger will produce annual post-tax synergies of $20 million. He expects Louieed Co’s current price-earnings (P/E) ratio to remain unchanged after the acquisition.

Extracts from the two companies’ most recent accounts are shown below:

The tax rate applicable to both companies is 20%.

Assume that Louieed Co can obtain further debt funding at a pre-tax cost of 7·5% and that the return on cash surpluses is 5% pre-tax.

Assume also that any debt funding needed to complete the acquisition will be reduced instantly by the balances of cash and cash equivalents held by Louieed Co and Tidded Co.

Required:

(a) Discuss the advantages and disadvantages of the acquisition of Tidded Co from the viewpoint of Louieed Co. (6 marks)

(b) Calculate the P/E ratios of Tidded Co implied by the terms of Louieed Co’s initial and proposed offers, for all three of the above options. (5 marks)

(c) Calculate, and comment on, the funding required for the acquisition of Tidded Co and the impact on Louieed Co’s earnings per share and gearing, for each of the three options given above.

Note: Up to 10 marks are available for the calculations. (14 marks)