Joe is the managing director and 100% shareholder of OK-Joe Ltd. He has always withdrawn t

he entire profits of the company as director’s remuneration, but given a recent increase in profitability he wants to know whether this basis of extracting the profits is beneficial.

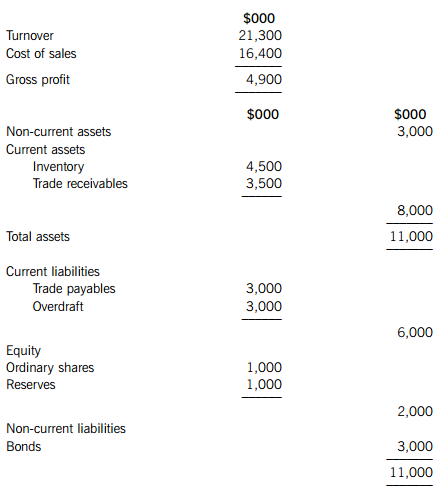

For the year ended 5 April 2016, OK-Joe Ltd’s taxable total profits, before taking account of director’s remuneration, are £65,000. After allowing for employer’s class 1 national insurance contributions (NIC) of £5,141, Joe’s gross director’s remuneration is £59,859.

The figure for employer’s NIC of £5,141 is after deducting the £2,000 employment allowance.

Required:

Calculate the overall saving of tax and NIC for the year ended 5 April 2016 if Joe had instead paid himself gross director’s remuneration of £8,000 and net dividends of £45,600.

Notes:

1. You are expected to calculate the income tax payable by Joe, the class 1 NIC payable by both Joe and OK-Joe Ltd, and the corporation tax liability of OK-Joe Ltd for the year ended 5 April 2016. 2. You should assume that the rate of corporation tax remains unchanged.

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“Assume that the rates and allo…”相关的问题

更多“Assume that the rates and allo…”相关的问题