题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

This website may contain links to other websites ____ privacy practices may be different from ours.

A.that

B.which

C.who

D.whose

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.that

B.which

C.who

D.whose

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“This website may contain links…”相关的问题

更多“This website may contain links…”相关的问题

the box(将求职信补充完整).

A.involves the successful management

B.would like to discuss my application further

C.can deal with

D.am a fully qualified social worker with 10 years of experience

E.ability to communicate and reach agreement

F.feel free to contact me

G.is first class

H.enclose my CV for your consideration

I.Yours Faithfully,

J.I look forward to hearing from you.

Dear Mark,

I am very keen to apply for the post of Social Worker that was recently advertised on your website and ().

I () in York City Council’s Social Work Department.My experience () of a demanding caseload that has included elderly people and people who have learning disabilities and / or mental health issues.I () what may be difficult and emotional issues in a calm and practical manner by finding out what is really important to the client’s needs.

My () with other agencies, such as primary care practices and psychology services,() and I have a team approach to establishing what is best of each individual.I am used to working unsocial hours, including evenings and weekends.

I () with you and welcome the opportunity to attend for interview.Please () on the details provided above in case you have any queries for me.

4 Assume today’s date is 15 May 2005.

In March 1999, Bob was made redundant from his job as a furniture salesman. He decided to travel round the world,

and did so, returning to the UK in May 2001. Bob then decided to set up his own business selling furniture. He

started trading on 1 October 2001. After some initial success, the business made losses as Bob tried to win more

customers. However, he was eventually successful, and the business subsequently made profits.

The results for Bob’s business were as follows:

Period Schedule D Case I

Trading Profits/(losses)

£

1 October 2001 – 30 April 2002 13,500

1 May 2002 – 30 April 2003 (18,000)

1 May 2003 – 30 April 2004 28,000

Bob required funds to help start his business, so he raised money in three ways:

(1) Bob is a keen cricket fan, and in the 1990s, he collected many books on cricket players. To raise money, Bob

started selling books from his collection. These had risen considerably in value and sold for between £150 and

£300 per book. None of the books forms part of a set. Bob created an internet website to advertise the books.

Bob has not declared this income, as he believes that the proceeds from selling the books are non-taxable.

(2) He disposed of two paintings and an antique silver coffee set at auction on 1 December 2004, realising

chargeable gains totalling £23,720.

(3) Bob took a part time job in a furniture store on 1 January 2003. His annual salary has remained at £12,600

per year since he started this employment.

Bob has 5,000 shares in Willis Ltd, an unquoted trading company based in the UK. He subscribed for these shares

in August 2000, paying £3 per share. On 1 December 2004, Bob received a letter informing him that the company

had gone into receivership. As a result, his shares were almost worthless. The receivers dealing with the company

estimated that on the liquidation of the company, he would receive no more than 10p per share for his shareholding.

He has not yet received any money.

Required:

(a) Write a letter to Bob advising him on whether or not he is correct in believing that his book sales are nontaxable.

Your advice should include reference to the badges of trade and their application to this case.

(9 marks)

Teachers are advised not to mark students work in red pen because______.

A.red color is too eye-catching

B.it may hurt students" feelings

C.it is against the state law

D.colors are too aggressive

The following scenario relates to questions 11–15.

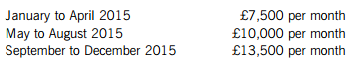

Alisa commenced trading on 1 January 2015. Her sales since commencement have been as follows:

The above figures are stated exclusive of value added tax (VAT). Alisa only supplies services, and these are all standard rated for VAT purposes. Alisa notified her liability to compulsorily register for VAT by the appropriate deadline.

For each of the eight months prior to the date on which she registered for VAT, Alisa paid £240 per month (inclusive of VAT) for website design services and £180 per month (exclusive of VAT) for advertising. Both of these supplies are standard rated for VAT purposes and relate to Alisa’s business activity after the date from when she registered for VAT.

After registering for VAT, Alisa purchased a motor car on 1 January 2016. The motor car is used 60% for business mileage. During the quarter ended 31 March 2016, Alisa spent £456 on repairs to the motor car and £624 on fuel for both her business and private mileage. The relevant quarterly scale charge is £294.

All of these figures are inclusive of VAT. All of Alisa’s customers are registered for VAT, so she appreciates that she has to issue VAT invoices when services are supplied.

From what date would Alisa have been required to be compulsorily registered for VAT and therefore have had to charge output VAT on her supplies of services?

A.30 September 2015

B.1 November 2015

C.1 October 2015

D.30 October 2015

What amount of pre-registration input VAT would Alisa have been able to recover in respect of inputs incurred prior to the date on which she registered for VAT?A.£468

B.£608

C.£536

D.£456

How and by when does Alisa have to pay any VAT liability for the quarter ended 31 March 2016?A.Using any payment method by 30 April 2016

B.Electronically by 7 May 2016

C.Electronically by 30 April 2016

D.Using any payment method by 7 May 2016

Which of the following items of information is Alisa NOT required to include on a valid VAT invoice?A.The customer’s VAT registration number

B.An invoice number

C.The customer’s address

D.A description of the services supplied

What is the maximum amount of input VAT which Alisa can reclaim in respect of her motor expenses for the quarter ended 31 March 2016?A.£108

B.£138

C.£180

D.£125

请帮忙给出每个问题的正确答案和分析,谢谢!

A.difficulty

B.trouble

C.adversity

D.dilemma

The website is very___with young people, who like its content and style.

A.familiar

B.popular

C.similar

D.interested