题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Chinese enterprise managers and business educators are now exploring the potential of the

A.extracting

B.exposing

C.examining

D.expanding

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.extracting

B.exposing

C.examining

D.expanding

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“Chinese enterprise managers an…”相关的问题

更多“Chinese enterprise managers an…”相关的问题

What is the amount of enterprise income tax (EIT) the Chinese borrower needs to withhold from the annual interest paid to the overseas bank?

A.USD6,000

B.USD15,000

C.USD5,700

D.USD14,250

Which of the following statements are correct?

(1) Co X is the taxpayer for China enterprise income tax (EIT)

(2) Co Y is the withholding agent for China EIT

(3) Co A is the withholding agent for China EIT

(4) The EIT should be filed at the place where Co

A.is located A 1 and 2

B.1, 3 and 4

C.1 and 4 only

D.3 and 4 only

我是安保部经理, 将协助这次安保工作

A.I’m a manager of the enterprise, who will assist you in this security department

B.I’m a manager of the security department. , who will assist you in this security work

C.The security manager who will assist you in this security work, is on the way

D.The security work will be assisted by the manager of the security department

“Would you rather go out for a Chinese or an Italian meal?"

“Oh,______”

A.I’m hungry"

B.I’m easy

C.I’m thinking

D.I’m working

A.Hi! I'm John. I'm from the USA

B.Hi! I'm John. I'm a Chinese

C.Hi! This is John

George:You’ve given US a wonderful Chinese dinner.Mrs.Li. Mrs.Li:

A.Oh,I"m afraid I didn’t cook very well.

B.I"m glad you enjoyed it.

C.Come again when you are free.

D.It’s not necessary for you to say so.

(a) Mr Xu, a domestic Chinese, is a designer. He is considering the following four options:

Option A: Joining Delta Ltd as a manager with a monthly salary of RMB40,000 and an annual bonus of RMB100,000 payable in December each year.

Option B: Providing services to Delta Ltd as a consultant for a consultancy fee of RMB50,000 per month.

Option C: Setting up his own sole proprietorship. He will pay himself a monthly salary of RMB20,000 from this sole proprietorship. For 2014 the net profit of the sole proprietorship after charging Mr Xu’s salary is expected to be RMB420,000.

Option D: Setting up a limited company, Xupa Ltd. He will pay himself a monthly salary of RMB20,000 from Xupa Ltd. For 2014 the net profit of the company after charging Mr Xu’s salary is expected to be RMB420,000. Xupa Ltd will pay enterprise income tax at the rate of 25% and distribute all of its profit after tax to its shareholder, Mr Xu, as a dividend.

Required:

Calculate the individual income tax (IIT) payable by Mr Xu for 2014 under each of the four options.

Note: Ignore value added tax and business tax. (10 marks)

(b) State, giving reasons, whether the following persons will be subject to individual income tax in China on their worldwide income in 2014:

(1) Ms Wang has her household in Xiamen and holds a China identity card. She has been studying in Australia since 2010 and has not returned to China for the last six years, including in 2014.

(2) Mr Beth is a US citizen, who has lived in China working for a non-government organisation since 2010. He has not travelled outside China for the last six years, including in 2014.

(3) Ms Ruth is an Australian citizen. She travelled to China and stayed in China for a total of 250 days in 2014. (5 marks)

A.You are quite right.I just think in Chinese.

B.I'm sorry,but I think in English.

C.You can say that again.

D.It's nonsense.

W: Sometimes. You know the life of a social worker is not all wonderful and working to help people in their daily life. I have to spend a lot of time pushing paper, and writing reports too. But when I do get out, yeah, I see a lot of foreigners. And sometimes they come in because life in America has just beaten them down and they can't cope financially or emotionally.

M: Really? I would think that they had a good support network in place, especially university students.

W: They do have a network, and a variety of support groups, but these can't meet all of the students' needs. They can't help with paying bills, dealing with American neighbors and customs, fitting in, getting a driver's license, etc. They try, but very often the student has to figure out a lot of this stuff by himself. And if he or she is shy, they don't have the courage to ask other people, even other people from their nationality.

M: So what are some of the things that overseas students struggle with?

W: This might interest you, but they struggle with the food, especially Chinese. You know, they come here knowing that Americans love Chinese food so much. They think that there will be good restaurants with Chinese food that they love. But they get here and they are extremely surprised. Americans enjoy totally different flavors.

M: So what do they do?

W: If they're brave and curious, they look around and test all the restaurants. There is usually at least one restaurant in every town that has almost quality food.

Questions 23 to 25 are based on the conversation you have just heard.

23. In which aspect does the woman help people in her work?

24. Why do people come to the woman for help?

25. How did Chinese students expect the American-made Chinese food before they came to the U.S?

(20)

A.Writing reports for them.

B.Teaching them foreign languages.

C.Helping them deal with daily existence.

D.Introducing work for them.

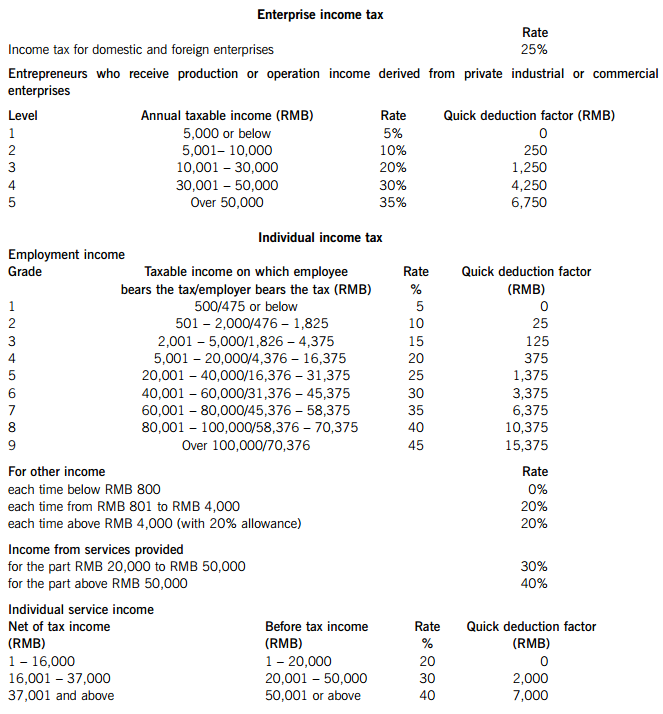

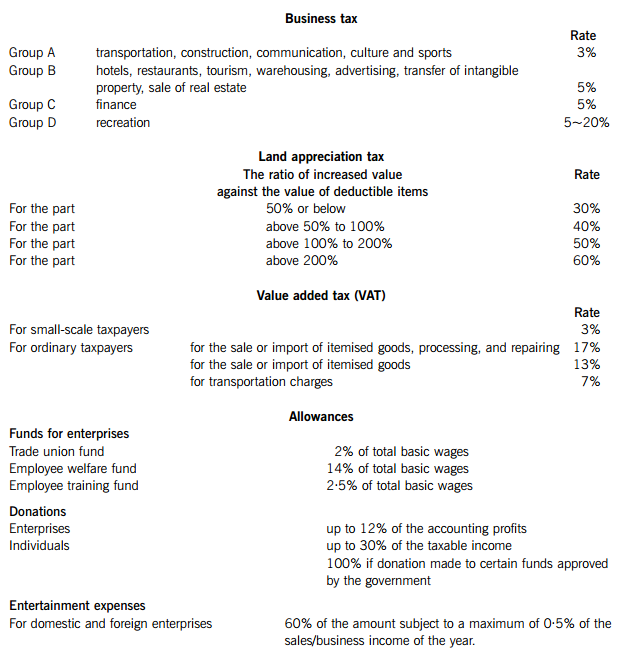

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. Apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

(a) The following is the statement of enterprise income tax (EIT) payable prepared by the accountant of Company P for the year 2010:

Notes:

(1) The union has not yet been set up and the expense is a general provision.

(2) The original cost of the fixed asset was RMB 150,000 and the accumulated depreciation was RMB 105,000, while the accumulated tax allowances claimed were RMB 120,000.

(3) The creditor had been liquidated three years ago.

(4) Last year (2009) was the first year a debtors provision was made. A general provision of RMB 500,000 was made but the whole amount was disallowed by the tax bureau. This year the management decided to write back part of provision amounting to RMB 150,000.

Required:

(i) Briefly comment on the correctness of the accountant’s treatment of the 12 items marked with an asterisk (*) in the income tax calculation sheet; (17 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company P for the year 2010. (6 marks)

(b) Briefly explain the term ‘arm’s length principle’ in the context of transactions between associated enterprises pursuant to the enterprise income tax law, together with the adjustment methods that may be used by the tax bureau in cases where this principle is not complied with. (6 marks)

(c) Company C, a limited company with equity of RMB 1,000,000, borrowed two loans from related companies:

– RMB 1,000,000 at a 7% annual interest rate from Company A; and

– RMB 2,000,000 at an 8% annual interest rate from Company B.

The market interest rate for the equivalent loans is a 6% annual interest rate.

In 2010, the interest paid to Company A and Company B was RMB 70,000 and RMB 160,000 respectively. The total amount of interest of RMB 230,000 was allocated RMB 140,000 to interest expense and RMB 90,000 to construction in progress in Company C’s accounts.

Required:

Calculate the amount of interest that will be disallowed for enterprise income tax under each of the account headings: interest expense and construction in progress. (6 marks)

2.

(a) Mr Y, a local Chinese national, a professional writer and artist, had the following income during 2010:

(1) Received income of RMB 45,000 for publishing the first edition of a book, and of RMB 15,000 for the second edition of the same book. The book was also published in a newspaper and he was paid RMB 5,250 for this.

(2) Sold one of his paintings for RMB 5,400.

(3) Gave a speech and was paid RMB 28,500.

(4) Acted as a translator for a movie and was paid RMB 60,000.

(5) Gave a speech in overseas country M and was paid the gross equivalent of RMB 27,000, from which the equivalent of RMB 6,750 in overseas tax was deducted at source.

(6) Sold one of his paintings in overseas country H, and was paid the gross equivalent of RMB 15,000, from which the equivalent of RMB 2,250 in overseas tax was deducted at source.

(7) Received interest of RMB 7,500 on a loan he had made to a domestic enterprise.

Required:

(i) Calculate the individual income tax (IIT) payable by Mr Y in respect of each of the items (1) to (7); (12 marks)

(ii) State how and when any IIT due on Mr Y&39;s overseas income will be reported and paid. (3 marks)

(b)

(i) State when a withholding agent must report and pay the individual income tax (IIT) deducted on a monthly basis from employment income; (1 mark)

(ii) List ANY FOUR situations in which an individual taxpayer needs to do self-reporting for IIT purposes. (4 marks)

3.

(a) Enterprise G, a general value added tax payer incorporated in Shenzhen for more than 20 years, had the following transactions in the month of May 2010. Some of the enterprises sales are subject to the standard value added tax (VAT) rate, while others are exempt (VAT) activities. All figures are stated including any applicable VAT:

(1) Sold product A (a standard VAT rate item) for RMB 400,000 and product B (a VAT exempt item) for RMB 350,000.

(2) In addition to the sales in (1) above, distributed product A with a market value of RMB 20,000 for staff welfare benefit.

(3) Purchased RMB 500,000 production materials, of which RMB 50,000 was used for a self-constructed building.

(4) Purchased RMB 200,000 agriculture product, of which RMB 20,000 was used for staff welfare benefit.

(5) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise G for the month of May 2010. (7 marks)

(b) Enterprise H, a small-scale value added tax payer, had the following transactions in the month of May 2010. All figures are stated including VAT:

(1) Sold product for RMB 20,000.

(2) Purchased RMB 500,000 of production materials.

(3) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise H on each of the above transactions, giving brief explanations of their treatment. (4 marks)

(c) Company X, a property developer, had the following transactions in 2010:

(1) Donated a new building to a high school. The cost of construction of the building was RMB 500,000 and the deemed profit rate is 10%.

(2) Contributed an office building as part of a capital contribution. The cost of the building was RMB 600,000 and the market value RMB 800,000.

(3) Sold an equity holding of unlisted stock for RMB 900,000. The equity holding had been obtained by the contribution of a factory building by Company X which had cost RMB 300,000.

(4) Obtained a six-month bank loan of RMB 2,000,000 from 1 July 2010 with the pledge of a shop owned by the company. During the loan period, the bank did not charge any interest, but instead the bank had the right to use the shop rent free. The market interest rate for a similar loan is 6% per year. At the end of the loan period, Company X sold the shop for a price which gave it RMB 1,000,000 more than the amount needed to repay the bank loan.

Required:

Calculate the business tax (BT) payable by Company X as a result of each of the above transactions (1) to (4), giving brief explanations of their treatment. (6 marks)

(d) State the THREE conditions that must be met for a transportation fee paid by the seller to be excluded from the sale consideration for the purposes of value added tax (VAT). (3 marks)

4.

(a) Company K carried out the following transactions:

(1) Imported a vehicle costing RMB 300,000 and paid transportation costs of USD 10,000 for the journey from the overseas supplier to the port in China.

(2) Shipped a machine with a value of RMB 500,000 overseas for repair and paid for materials of USD 10,000 and a repairing fee of USD 30,000. The machine was shipped back to China in the same month.

(3) Subcontracted some domestic raw materials valued at RMB 200,000 to an overseas company. The related fee and transportation costs were USD 100,000 and USD 20,000 respectively.

(4) Imported raw materials costing RMB 30,000,000 and paid transportation costs of USD 50,000 for the journey from the overseas supplier to the port in China. After the arrival of the materials, Company K discovered that 20% of the materials had a quality problem. The supplier agreed to ship a further 20% replacement materials at no cost to Company K in the same month. Both parties agreed that the quality problem goods should be kept in China.

Required:

Calculate the customs tariff, consumption tax (CT) and value added tax (VAT) payable by Company K as a result of each of the above transactions.

Note: for the purposes of your calculations you should assume that:

(1) The customs tariff for all kinds of imported goods is 20%.

(2) The rate of consumption tax (CT) is 10%.

(3) The USD:RMB exchange rate is 1:6·6

(b) Briefly explain the procedures, including any time limits, for the declaration and payment of the customs

5.

Briefly explain the consequences of the following actions, including any fines or other penalty that may be imposed:

(a) Failure to keep or maintain proper accounting records/vouchers. (2 marks)

(b) Failure to file a return within the prescribed time limit. (2 marks)

(c) Failure to file a return and hence not paying or paying less tax than is duly payable. (1 mark)

(d) Failure to pay tax by concealment of property. (3 marks)

(e) Refusal to pay tax by violence or menace. (2 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!